RIG Update #4 — Columbia Cryptoeconomics 2023 + ASSA 2024

Plus: Strategic bidding wars in on-chain auctions, semantics of staking, timing games mitigations, and properties of issuance levels.

This is our first Robust Communication from the new year, with our team reporting after two events of very different dimensions.

The Columbia Cryptoeconomics workshop (detailed below) featured two days of talks by leading researchers of industry and academia.

Meanwhile, the ASSA Annual Meeting 2024 united the most diverse fields from “traditional” economics. We were lucky to feature in the “Economics of Ethereum” session, where Caspar presented the Timing games paper (see our first issue for more on the paper).

And of course, we have plenty more to share, so let’s dive in.

📜 Strategic bidding wars in on-chain auctions

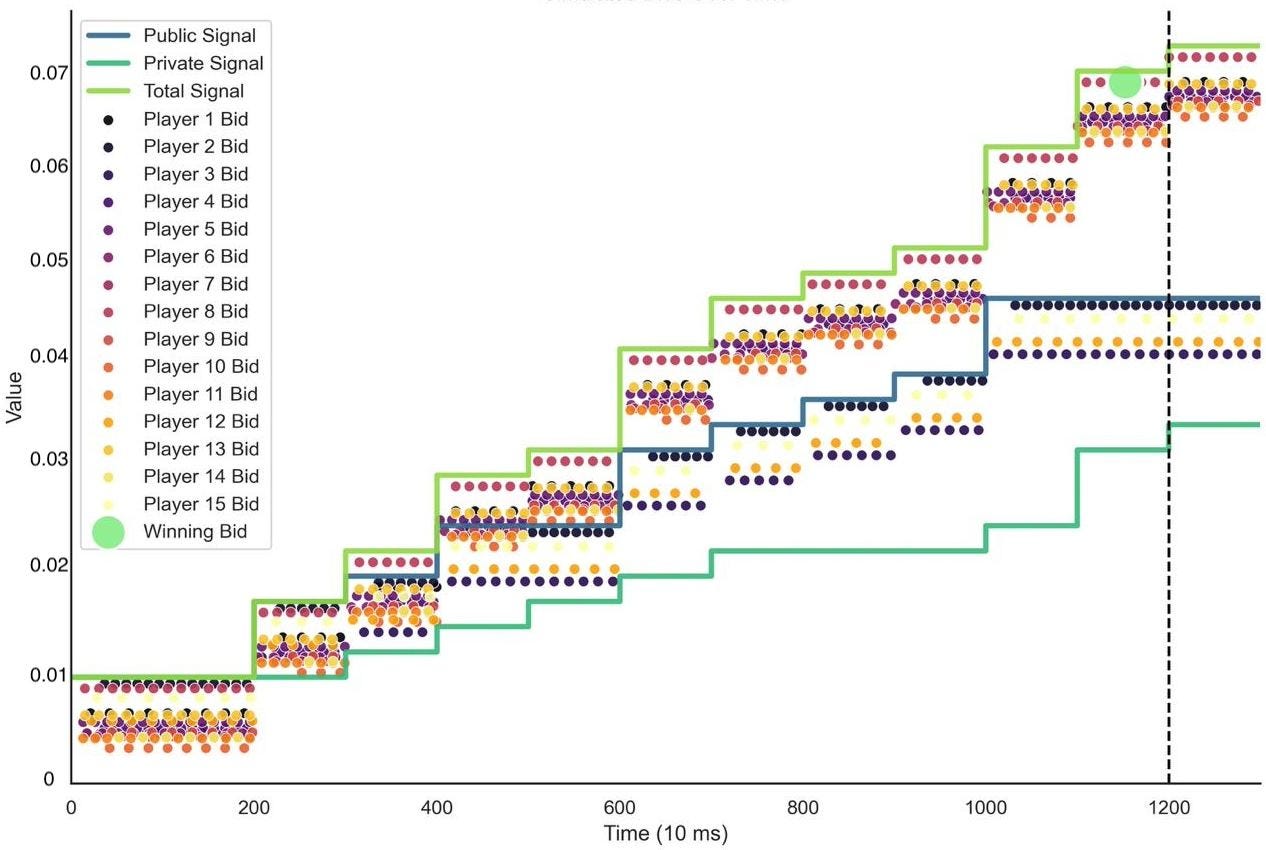

Thomas contributed to the recent paper “Strategic Bidding Wars in On-chain Auctions” with first author Fei Wu and co-authors Stefanos Leonardos and Carmine Ventre.

Abstract: The Ethereum block-building process has changed significantly since the emergence of Proposer-Builder Separation. Validators access blocks through a marketplace, where block builders bid for the right to construct the block and earn MEV (Maximal Extractable Value) rewards in an on-chain competition, known as the MEV-Boost auction. While more than 90% of blocks are currently built via MEV-Boost, trade-offs between builders' strategic behaviors and auction design remain poorly understood. In this paper we address this gap. We introduce a game-theoretic model for MEV-Boost auctions and use simulations to study different builders' bidding strategies observed in practice. We study various strategic interactions and auction setups and evaluate how the interplay between critical elements such as access to MEV opportunities and improved connectivity to relays impact bidding performance. Our results demonstrate the importance of latency on the effectiveness of builders' strategies and the overall auction outcome from the proposer's perspective.

Check out the paper on arXiv!

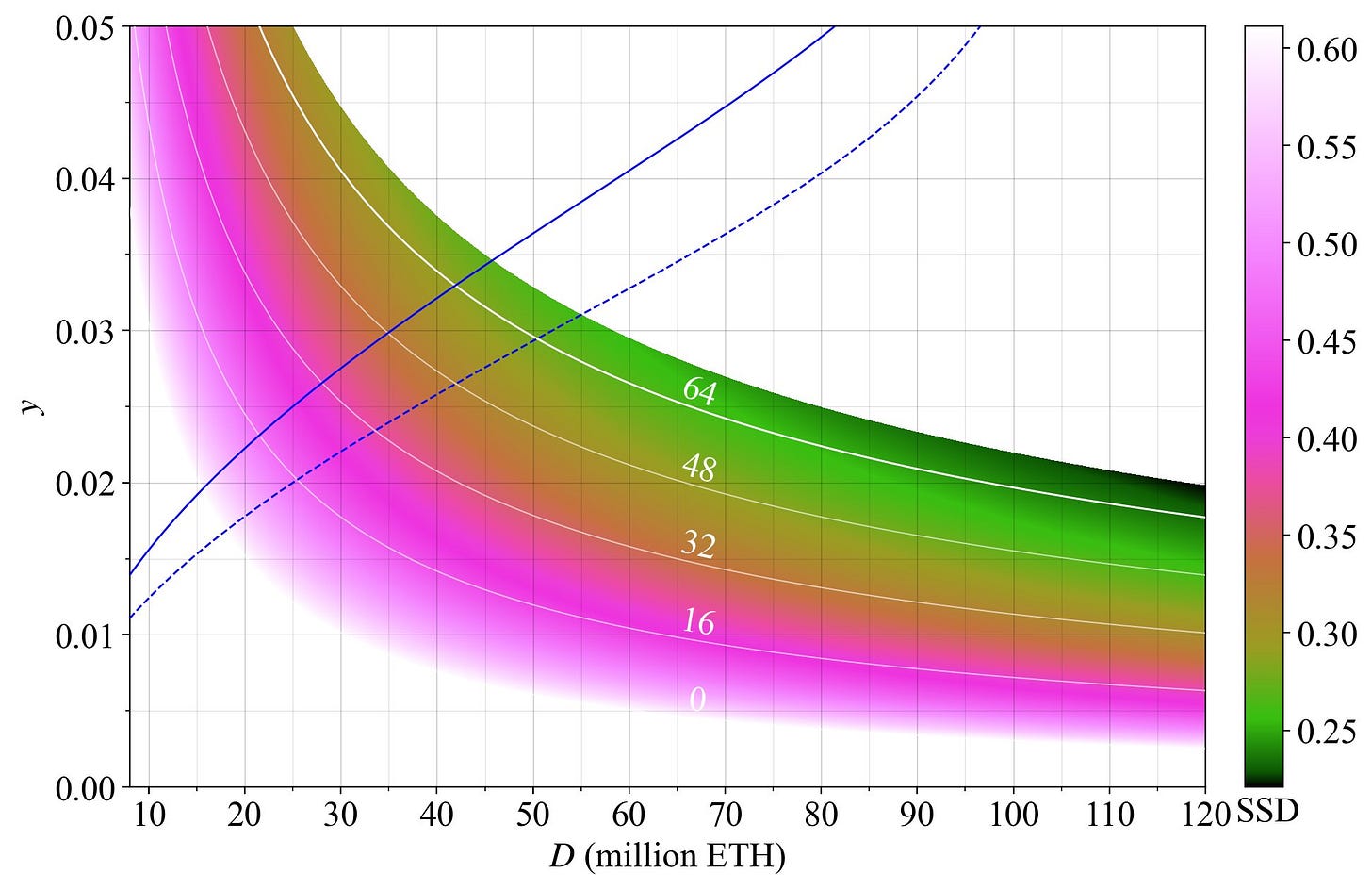

📝 Properties of issuance level

Anders shared a new 116-tweet-long thread on the properties of issuance level, before expanding on the presentation with a new long-form ethresear.ch post.

In my last thread, minimum viable issuance was introduced as an important guideline for staking economics. This thread will take a closer look at how issuance level affects Ethereum’s equilibrium staking conditions and guide us toward a utility-maximizing reward curve.

Find the ethresear.ch post here.

🎪 Columbia Cryptoeconomics workshop

On December 6-7th, we attended the Columbia Cryptoeconomics workshop (CCE) in New York. The main event lasted 2 days, and we met with around 300 upper- and lowercase [R,r]esearchers to discuss all things cryptoeconomics. Some of us argued it was the best conference of the year 👀 and the vibes were immaculate indeed. A good mix of academic and industry folks, topics focused on fee markets, PBS & MEV and (re)staking economics, and discussions that kept going at all times. A couple of handpicked highlights:

Justin Drake introduced Attester-Proposer Separation for the first time now rebranded Execution Tickets, as a entirely new protocol design allowing anyone to buy a lottery ticket and win the right to propose a block in the future.

Sam Hart gave a great overview of the challenges and trade-offs faced when designing cross-chain, multi-currency fee markets.

Kubi Mensah talked about vertical integration across searchers/builders/relays across the Ethereum supply network: this was a recurring theme throughout the conference as it impacts decentralization and censorship resistance properties.

Ari Juels on bribe and extortion games in DAOs, Sreeram Kannan on a mechanism designed to obtain staking insurance and protect users from attacks on safety in PoS blockchain.

The list goes on, check out all the talks and videos here 📽️!

Don’t miss the session on Staking macroeconomics hosted by Davide, with his Staking State of the Union:

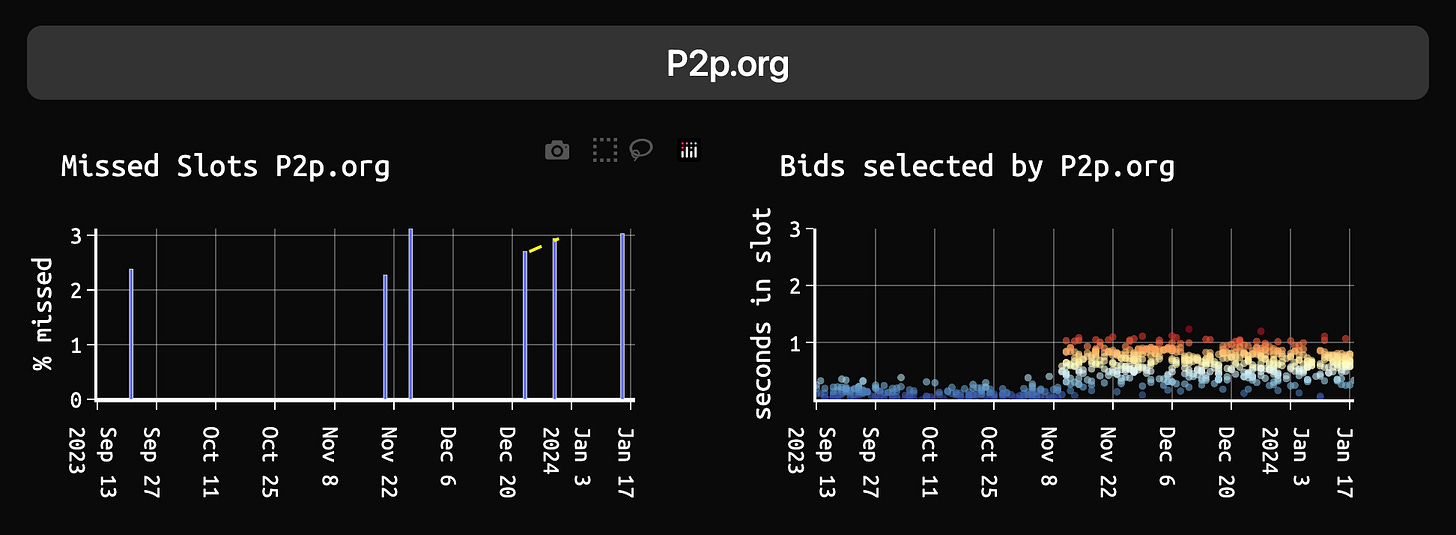

📝 Timing games: Implications and possible mitigations

Caspar and Mike discuss implications and possible mitigations of the recently observed timing games. These games involve block proposers delaying the release of their block to accumulate more MEV, at the expense of the next block proposer. While the paper by Caspar and co-authors, released in May 2023, showed that then-current network conditions did not consist in an equilibrium, no game was played at the time. This changed in recent months, with more operators experimenting with or deploying strategies to capture more value.

Can the genie be put back in the bottle? Incentives would tell us otherwise, so the post lays out the current environment and ideas to either manage or learn to live with timing games. Find it on ethresear.ch!

See also: Two reports from node operators (Kiln and Chorus One) on timing games.

📝 Semantics of staking (parts 1 and 2)

Barnabé introduced a “balance sheet view” of Liquid Staking Tokens and re-staking at ETHconomics 2 (Devconnect Istanbul). Two posts are out, with a third one to appear soon, containing models and more context on these balance sheets.

Check the posts below:

🎪 IC3 Winter Retreat and CfC. St Moritz Conference

Julian joined both the IC3 Winter Retreat and CfC. St Moritz Conference Academic Research Track, hosted one after the other in Switzerland this January. Here is his account:

The IC3 retreat spanned 4 days in beautiful Les Diablerets. It was a great opportunity to get to know academics from various universities and other industry professionals that work on a variety of problems within blockchains. I presented ongoing work with Davide here about endogenously modelling the liquidity supply in AMMs. A small selection of the many interesting papers that were briefly presented in the lightning talks consist of: The Costs of Swapping on the Uniswap Protocol presented by Benjamin Chan, Buying Time: Latency Racing vs. Bidding in Transaction Ordering presented by Akaki Mamageishvili and DAO Decentralization: Voting-Bloc Entropy, Bribery, and Dark DAOs presented by James Austgen and Sarah Allen.

The CfC. Conference focused instead on decentralized finance. Some of the topics that were covered include, CBDCs by Krzysztof Gogol, arbitrage in Algorand by Burak Öz and regulation of cryptoassets. I presented a poster here on the same ongoing work with Davide concerning liquidity provision in automated market makers.

Stay tuned for the full paper on liquidity supply in AMM, by Julian and Davide!

🧑💻 Extra bytes

The 11th EF Research AMA on Reddit has a few answers from RIG members and EF researchers on a wide range of questions, including staking economics, EigenLayer and decentralised commitments for cooperative AIs.

Work is ongoing on two new ROPs! Stay tuned for more announcements on our Open Problems 👀

You can find all of our work at our new address, rig.ethereum.org 🥳