RIG Update #3 — Protocol Berg + Devconnect

ETHconomics, pricing blockchain resources, decentralized commitment devices for AI, and much much more

Hi everyone, and welcome to our third edition of the Robust Communications! This issue is packed, and probably should have been two separate letters, but we didn’t get to it and now we have so much to tell you 🥳

Before we jump in, a quick plug for an upcoming event we are involved in, the Columbia Cryptoeconomics workshop (CCE), held in New York on December 6-7. Expect talks and discussions on PBS, MEV, staking economics, and many more topics.

There are still a couple of days to apply for a ticket! Apply here as attendee before November 27th.

We hope to see you in New York, and now on to the news!

📝 Anders’ thread on Minimum Valuable Issuance (MVI)

Staking economics were on everyone’s mind in the last few months. Along with this renewed attention, a flurry of proposals and posts were published, among which the EIP to cap the churn limit of validator entries and exits (EIP-7514), Mike Neuder’s “Magnitude and direction of Lido attack vectors”, and many more.

Anders joined our team following his “Circulating Supply Equilibrium for Ethereum and Minimum Viable Issuance during the Proof-of-Stake Era” post on ethresear.ch. Since then, he has been plugging away at an exhaustive exploration of the Ethereum staking economics, along with proposals to review the current emission schedule. You can read his answer during a recent Reddit AMA to learn more about the approach.

An opening salvo before releasing more of his work over the next months, Anders published a 118 tweet-long thread on Minimum Viable Issuance. From the first tweet (which we cannot embed because X hates Substack):

I consider minimum viable issuance to be an important pledge to the regular Ethereum user. Staking should secure Ethereum, but not become an inflation tax, degrading utility and liquidity while generating monopolistic hazard. A thread on staking economics 🧵

It only gets better from here, so we’ll let you dive into it, but if you are X-averse, you can also check out the thread as a post here.

🎪 ETHconomics 2 @ Devconnect Istanbul

We were excited to host ETHconomics 2 on November 15th during Devconnect Istanbul. The event featured three distinct sessions on fee markets, staking economics and the theory of Automated Market Makers, in a relaxed setting to engage in conversations between fellow researchers and Researchooors.

Find below the many amazing talks that we hosted, or check out all the videos from the Streameth page:

Transaction fee mechanisms

Transaction Fee Mechanism Design with Active Block Producers

Maryam Bahrani (a16z Crypto)Optimal Dynamic Fees for Blockchain Resources

Davide Crapis (Robust Incentives Group)Resources, Targets and Pricing

Akaki Mamageishvili (Offchain Labs)

Staking economics

Semantics of Staking: Fun and Games (and Balance Sheets) with Staking Tokens

Barnabé Monnot (Robust Incentives Group)Staking Economics Panel

Davide Crapis, Dankrad Feist, Barnabé Monnot (Ethereum Foundation)

Mechanism design for AMMs

What Do We Still Need to Learn About Trading on DEXs?

Alexander Nezlobin (building…)Arbitrageurs’ Profits, LVR and Sandwich Attacks: Batch Trading as an AMM Design Response

Andrea Canidio (CoW Protocol)

Fun fact: Our MC for the day was Julian, who started out as a volunteer for the first ETHconomics back in April 2022, and is now a research scientist at RIG! Julian made this second iteration a success, taking on most of the planning duties with the support of the EF events team. Many thanks to all involved, and Julian in particular! ❤️

📜 Optimal dynamic fees for blockchain resources

Davide published a new paper along with co-authors Ciamac C. Moallemi and Shouqiao Wang (Columbia University), “Optimal Dynamic Fees for Blockchain Resources”. If you loved EIP-1559 (whether you’re willing to admit it or not), you’ll love this one too.

We develop a general and practical framework to address the problem of the optimal design of dynamic fee mechanisms for multiple blockchain resources. Our framework allows to compute policies that optimally trade-off between adjusting resource prices to handle persistent demand shifts versus being robust to local noise in the observed block demand. In the general case with more than one resource, our optimal policies correctly handle cross-effects (complementarity and substitutability) in resource demands. We also show how these cross-effects can be used to inform resource design, i.e. combining resources into bundles that have low demand-side cross-effects can yield simpler and more efficient price-update rules. Our framework is also practical, we demonstrate how it can be used to refine or inform the design of heuristic fee update rules such as EIP-1559 or EIP-4844 with two case studies. We then estimate a uni-dimensional version of our model using real market data from the Ethereum blockchain and empirically compare the performance of our optimal policies to EIP-1559.

📜 Economics of EIP-4844

And if you really love EIP-1559, then you’ll love having two of them, which is what EIP-4844 intends to offer by opening up a new market specialised in data publication for rollups. But as Davide’s previous paper on optimal dynamic fees teaches us, cross-effects between resources matter, and in this case, they lead to fascinating results on the usage of both markets in various scenarios, despite the a priori “independence” of the two. Davide and his co-authors Ed Felten and Akaki Mamageishvili (Offchain Labs) detail it all in their new “EIP-4844 Economics and Rollup Strategies”:

We study the economics of the Ethereum improvement proposal 4844 and its effect on rollups' data posting strategies. Rollups' cost consists of two parts: data posting and delay. In the new proposal, the data posting cost corresponds to a blob posting cost and is fixed in each block, no matter how much of the blob is utilized by the rollup. The tradeoff is clear: the rollup prefers to post a full blob, but if its transaction arrival rate is low, filling up a blob space causes too large delay cost. The first result of the paper shows that if a rollup transaction arrival rate is too low, it prefers to use the regular blockspace market for data posting, as it offers a more flexible cost structure. Second, we show that shared blob posting is not always beneficial for participating rollups and change in the aggregate blob posting cost in the equilibrium depends on the types of participating rollups. In the end, we discuss blob cost-sharing rules from an axiomatic angle.

📜 Cooperative AI via Decentralized Commitment Devices

A new paper including some RIG co-authors, “Cooperative AI via Decentralized Commitment Devices” was recently accepted at a NeurIPS workshop, MASEC (Multi-Agent Security Workshop). The work is a collaboration between Xinyuan Sun (Flashbots), Davide Crapis (EF RIG), Matt Stephenson (Pantera Capital), Barnabé Monnot (EF RIG), Thomas Thiery (EF RIG) and Jonathan Passerat-Palmbach (Flashbots).

Credible commitment devices have been a popular approach for robust multi-agent coordination. However, existing commitment mechanisms face limitations like privacy, integrity, and susceptibility to mediator or user strategic behavior. It is unclear if the cooperative AI techniques we study are robust to real-world incentives and attack vectors. However, decentralized commitment devices that utilize cryptography have been deployed in the wild, and numerous studies have shown their ability to coordinate algorithmic agents facing adversarial opponents with significant economic incentives, currently in the order of several million to billions of dollars. In this paper, we use examples in the decentralization and, in particular, Maximal Extractable Value (MEV) literature to illustrate the potential security issues in cooperative AI. We call for expanded research into decentralized commitments to advance cooperative AI capabilities for secure coordination in open environments and empirical testing frameworks to evaluate multi-agent coordination ability given real-world commitment constraints.

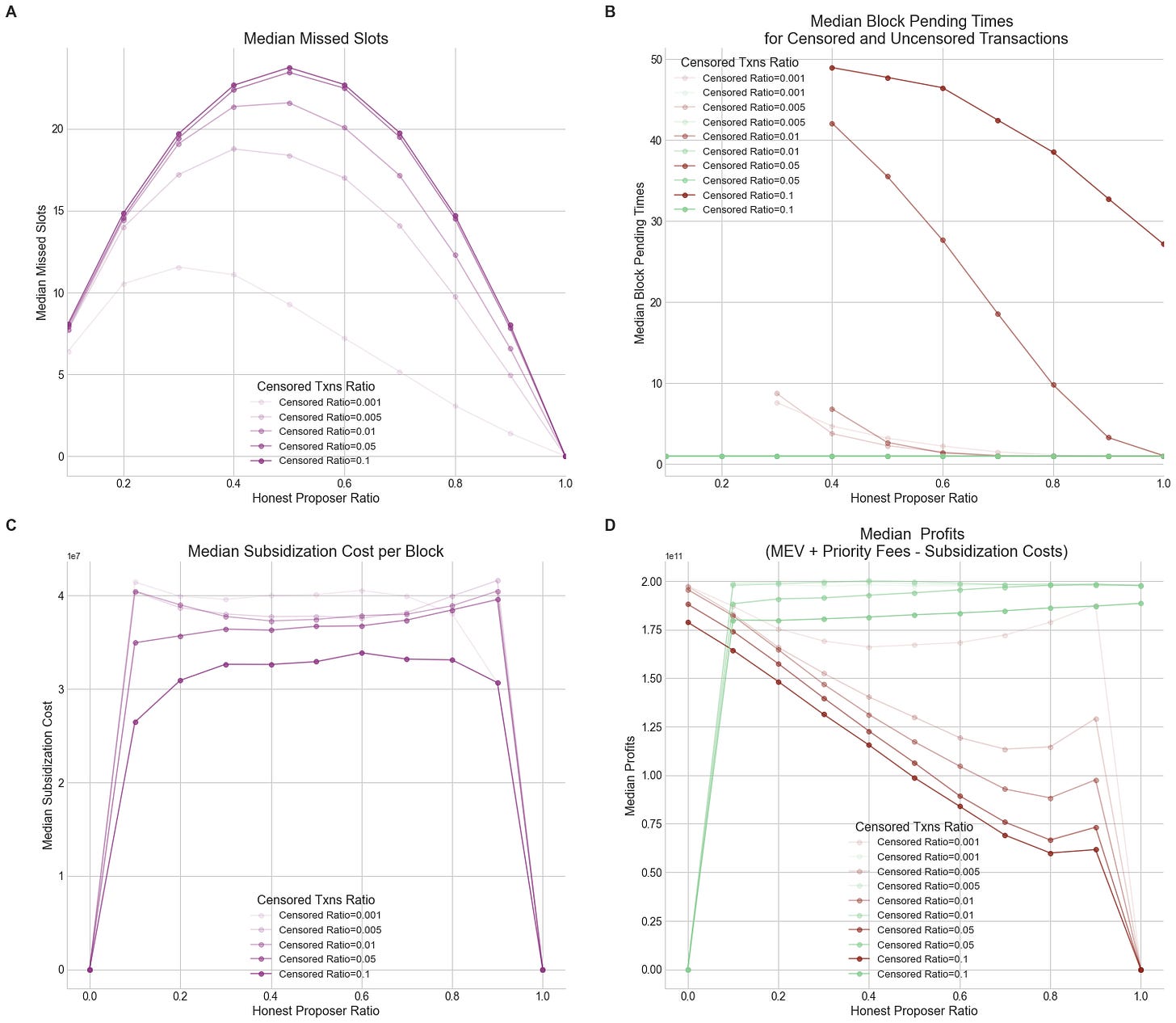

📝 The Costs of Censorship: A Modeling and Simulation Approach to Inclusion Lists

Thomas published this new post on ethresear.ch, specifying models and simulations to validate inclusion list designs. As is now customary in a Thomas post, you will find amazing plots and insights.

In this post, we provide a modeling approach to CR and inclusion lists, to uncover the games and trade-offs involved in the dynamic interactions between honest and censoring proposers. Utilizing an implementation of the proposed model, we then define key metrics to measure economic and CR attributes under various scenarios.

Read on here.

🎪 The Blockspace Expo @ Protocol Berg

A high point in the last few months was Protocol Berg, organised by the amazing team behind ETHBerlin. While the aesthetics were inspired by the cold, formal layout of a LaTeX whitepaper, the conference was anything but. Eschewing the traditional crypto conference hallmarks (sponsors, shill talks, flashy swag), the event featured an amazing mix of deep speakers, either technical or not, from many different ecosystems.

Our “Blockspace Expo” special event was held during Protocol Berg. Five researchers from all corners of the crypto-ecosystem gathered to present the design philosophy behind their blockspace, and discuss commonalities and differences in a panel. The session featured Christopher Goes (Heliax/Anoma), Robert Habermeier (formerly Parity Technologies, still involved in Polkadot), Sam Hart (Skip Protocol), Jannik Luhn (Shutter Network) and Barnabé.

The Expo surfaced multiple viewpoints on diverse topics such as the ability to schedule and offer products related to on-chain activity, the market for commitments, the current state of user demand and its satisfaction by protocol services, and many more. Check out the recording below.

🧑💻 Extra bytes

Barnabé jumped on the Cosmos forum to discuss EIP-1559 questions and concerns, including its role and its relation to censorship-resistance.

Davide presented his “Rollup Economics 2.0” post at the AltLayer Rollup Frontier Day event during Devconnect. The video is not out yet, but here are the slides.

Barnabé presented Scaling Ethereum: Rollup Economics (slides) online for the Crypto and Blockchain Economics Research Forum (CBER), an overview of rollup architectures and recent results.

Thank you for reading, and see you very soon after CCE!